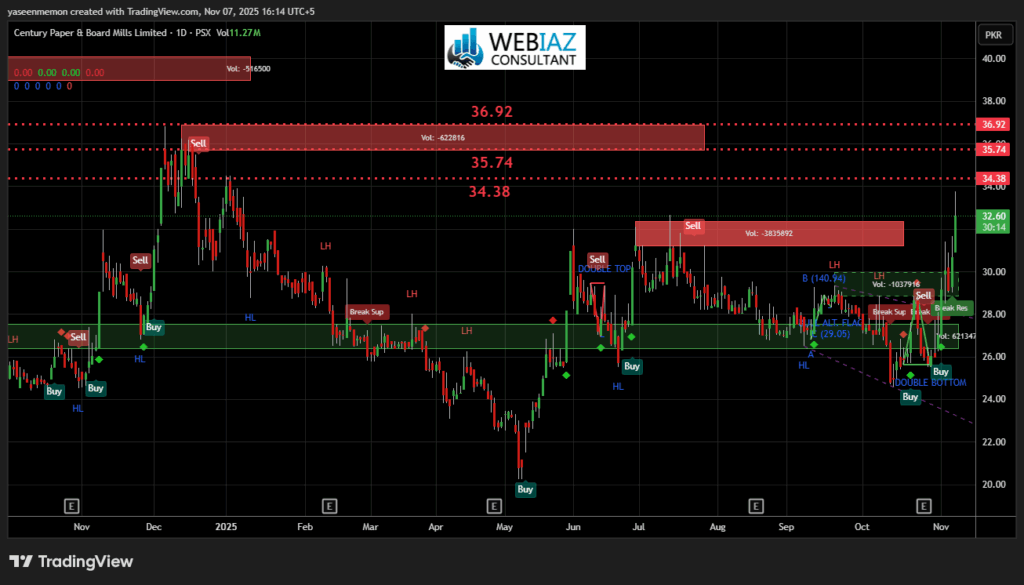

Century Paper & Board Mills Limited (CEPB) has formed a strong Double Bottom pattern, signaling the beginning of a bullish reversal after a prolonged consolidation phase. The stock rebounded sharply from the 26–27 support zone, confirming renewed buyer interest and volume strength.

Key Technical Highlights:

- Pattern: Double Bottom confirmed above neckline

- Breakout Zone: 29.00 – 30.50 levels

- Resistance Levels: 34.38, 35.74, 36.92

- Support Zone: 26.50 – 27.00

- Volume: Rising buying volume confirms breakout strength

If the price sustains above 30.50, the next upside targets are expected between 34.00 and 36.90. However, a close below 27.00 could weaken the current bullish structure.

Outlook:

The overall sentiment on CEPB remains bullish in the short to mid-term, with technical indicators supporting upward momentum. Pullbacks toward support zones may offer attractive risk-to-reward buying opportunities for traders.

Analysis by: WEBIAZ Technical

🌐 Pakistan Stock Market | Data-Driven Trading Insights